If sales revenues decrease, operating income will decrease at a much larger rate. It simply indicates that variable costs are the majority of the costs a business pays. While the company will earn less profit for each additional unit of a product it sells, a slowdown in sales will be less problematic becuase the company has low fixed costs. The high leverage involved in counting on sales to repay fixed costs can put companies and their shareholders at risk. High operating leverage during a downturn can be an Achilles heel, putting pressure on profit margins and making a contraction in earnings unavoidable. Indeed, companies such as Inktomi, with high operating leverage, typically have larger volatility in their operating earnings and share prices.

Get in Touch With a Financial Advisor

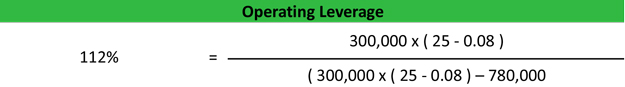

The DOL ratio helps analysts determine what the impact of any change in sales will be on the company’s earnings. That indicates to us that this company might have huge variable costs relative to its sales. Similarly, we can conclude the same by realizing how little the operating leverage ratio is, at only 0.02. This means that they are fixed up to a certain sales volume, varying to higher levels when production and sales volume increase. Under all three cases, the contribution margin remains constant at 90% because the variable costs increase (and decrease) based on the change in the units sold. Intuitively, the degree of operating leverage (DOL) represents the risk faced by a company as a result of its percentage split between fixed and variable costs.

Sales Growth

The Operating Leverage measures the proportion of a company’s cost structure that consists of fixed costs rather than variable costs. Most of a company’s costs are fixed costs that recur each month, such as rent, regardless of sales volume. As long as a business earns a substantial xero accounting software review for 2021 profit on each sale and sustains adequate sales volume, fixed costs are covered, and profits are earned. Operating margins are the key to a successful company because survival is not an option if the company isn’t producing operating profits at some point in its life cycle.

What Does the Degree of Operating Leverage Indicate?

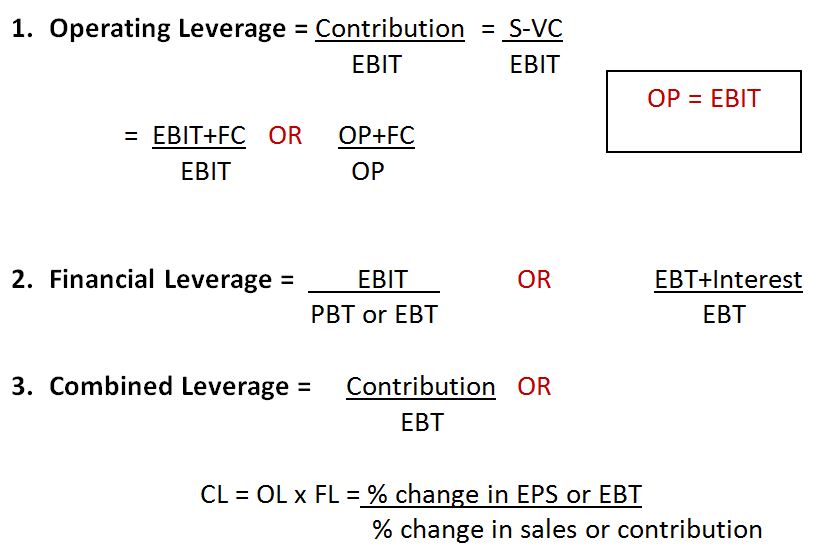

The degree of operating leverage (DOL) measures how much change in income we can expect as a response to a change in sales. In other words, the numerical value of this ratio shows how susceptible the company’s earnings before interest and taxes are to its sales. The degree of operating leverage calculator is a tool that calculates a multiple that rates how much income can change as a consequence of a change in sales. In this article, we will learn more about what operating leverage is, its formula, and how to calculate the degree of operating leverage.

- Companies with higher leverage possess a greater risk of producing insufficient profits since the break-even point is positioned higher.

- Getting to the good stuff now, let’s go back to our diagram from above and dissect how to calculate operating leverage.

- In contrast, a company with low operating leverage will experience less volatility when revenues change.

- There are fewer variable costs in a cost structure with a high degree of operating leverage, and variable costs always cut into added productivity—though they also reduce losses from lack of sales.

- Companies with high fixed costs tend to have high operating leverage, such as those with a great deal of research & development and marketing.

In contrast, a company with low operating leverage will experience less volatility when revenues change. Companies with higher degrees of operating leverage, like Microsoft, will experience larger changes in profits during revenue changes. Investors can come up with a rough estimate of DOL by dividing the change in a company’s operating profit by the change in its sales revenue. This section will use the financial data from a real company and put it into our degree of operating leverage calculator.

What is your current financial priority?

Bigger debt loads lead to higher interest expenses, decreasing operating profits. The biggest drivers of operating leverage are fixed or variable costs compared to the revenue. The fixed and variable costs equal the total costs a company expends to operate the business. It includes raw materials, inventory, payroll, R&D, marketing, administration, compensation expenses, and commissions. Companies with high operating leverage can make more money from each additional sale if they don’t have to increase costs to produce more sales. The minute business picks up, fixed assets such as property, plant and equipment (PP&E), as well as existing workers, can do a whole lot more without adding additional expenses.

The company has fairly low levels of fixed costs, while its variable costs are large. For each product sale that Walmart rings in, the company has to pay for the supply of that product. As a result, Walmart’s cost of goods sold (COGS) continues to rise as sales revenues rise. In finance, companies assess their business risk by capturing a variety of factors that may result in lower-than-anticipated profits or losses. One of the most important factors that affect a company’s business risk is operating leverage; it occurs when a company must incur fixed costs during the production of its goods and services. A higher proportion of fixed costs in the production process means that the operating leverage is higher and the company has more business risk.

The company’s fixed costs are costs they have to pay regardless of sales, such as rent, insurance, and taxes. And when sales fall, these fixed costs don’t move, causing bigger drops in profits. A great example is an amusement park like Six Flags, which has high operating leverage. With over 75% fixed costs and labor occupying the highest cost, when the parks were shuttered during Covid, they lost huge, but the parks will see growing profitability as they reopen.